Recap for December 22

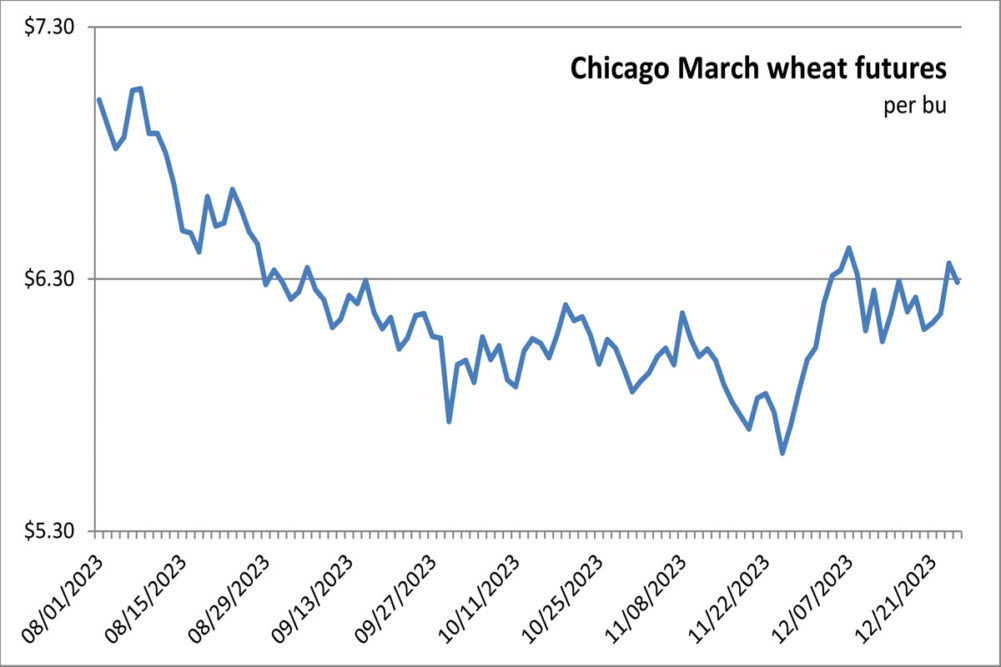

- Wheat futures jumped higher Tuesday on fresh concerns about safe shipping in the Black Sea after Ukraine missiles struck a Russian warship in Crimea, with short covering also a feature. Higher crude oil prices (supported by turbulence in the Mideast and ideas of US economic strength) gave corn and soybean futures a boost. Market moves often are more extreme amid thin holiday trading. March corn futures added 7¼¢ to close at $4.80¼ per bu. Chicago March wheat jumped 20¢ to close at $6.36¼ per bu. Kansas City March wheat added 19¾¢ to close at $6.42¾ per bu. Minneapolis March wheat was up 15¢ to close at $7.29¼ per bu. January soybeans gained 13½¢ to close at $13.13¼ per bu. January soybean meal was up $3.60 to close at $403.20 per ton. January soybean oil lost 0.62¢ to close at 47.91¢ a lb.

- US equity indexes started the final week of the year with higher closes Tuesday mainly on ideas the Federal Reserve will begin to cut interest rates in March 2024. Trading volume was light between the holiday weekends. The yearend “Santa Clause” effect appeared to overshadow concerns that the market was in overbought territory. The Dow Jones Industrial Average added 159.36 points, or 0.43%, to close at 37,545.33. The Standard & Poor’s 500 was up 20.12 points, or 0.42%, to close at 4,774.75. The Nasdaq Composite gained 81.60 points, or 0.54%, to close at 15,074.57.

- US crude oil prices advanced Tuesday amid growing tensions in the Mideast. The February sweet crude future was up 2.01¢ to close at $75.57 per barrel.

- The US dollar index declined Tuesday.

- US gold futures were higher Tuesday. The February contract added 70¢ to close at $2,069.80 per oz.

Recap for December 21

- A weaker dollar lent support to grains on Thursday, helping Chicago soft red winter futures climb in a technical bounce. But Kansas City and Minneapolis futures were mostly lower, the latter to the lowest levels since Dec. 14, after French-based consultancy Strategie Grains said in its first projections for 2024-25 that global wheat production is expected to rebound. Also rising on a technical bounce was corn futures, which consolidated after striking contract lows in the previous session amid concerns over possible US export disruptions due to US-Mexico rail border crossings being closed by the US government due to migrant crossings. Rainy forecasts for dry Brazil pressured US soybean futures. March corn futures added 2¾¢ to close at $4.72½ per bu. Chicago March wheat was up 2½¢ to close at $6.12½ per bu. Kansas City March wheat added 1¾¢ to close at $6.26¾ per bu; the July contract and beyond were narrowly lower. Minneapolis March wheat was down 3¾¢ to close at $7.14¼ per bu. January soybeans dropped 11¢ to close at $12.97¼ per bu. January soybean meal was down $4.50 to close at $395.40 per ton. January soybean oil shed 1.52¢ to close at 49.04¢ a lb.

- US equity indexes resumed their climb Thursday, the S& P 500 hopping back on track for an eighth weekly gain, after the US central bank’s preferred inflation indicator rose by 2% in the third quarter, less than previously estimated. It was the latest signal the US economy is cooling gradually, as policy makers have hoped. The Dow Jones Industrial Average added 322.35 points, or 0.87%, to close at 37,404.35. The Standard & Poor’s 500 was up 48.40 points, or 1.03%, to close at 4,746.75. The Nasdaq Composite jumped 185.92 points, or 1.26%, to close at 14,963.87.

- US crude oil prices closed lower Thursday after advancing for three days. The February West Texas Intermediate light, sweet crude future was down 33¢ to close at $73.89 per barrel.

- The US dollar index reverted back to the downside Thursday where it lived for most of the preceding seven trading days.

- US gold futures were higher Thursday. The February contract was up $3.60 to close at $2,051.30 per oz.

Recap for December 20

- Position squaring ahead of Christmas weekend sent wheat futures lower Wednesday. Further pressure on wheat came from twinned hikes to wheat harvest estimates in the Black Sea region after SovEcon raised its Russian wheat harvest forecast to 91.3 million tonnes from 89.8 million, while APK-Inform increased its Ukraine grain harvest forecast to 56.3 million tonnes from 54.7 million. Corn futures closed lower, the two front months at contract lows, two days after the US government closed the Eagle Pass and El Paso rail bridges into Mexico in order to “redirect personnel” to process migrants crossing the border. The National Grain and Feed Association in a Dec. 20 letter to Homeland Security Secretary Alejandro Mayorkas said the impact already was being felt. Soybean futures slid on Wednesday, as market participants kept tracking weather forecasts in drought-hit Brazil and adjusted their positions ahead of the holidays. March corn futures fell 3¢ to close at $4.69¾ per bu. Chicago March wheat dropped 12¾¢ to close at $6.10 per bu; the furthest deferred 2025 contracts edged higher. Kansas City March wheat fell 16½¢ to close at $6.25 per bu. Minneapolis March wheat was down 10¼¢ to close at $7.18 per bu. January soybeans eased 4¼¢ to close at $13.08¼ per bu. January soybean meal was down $3.30 to close at $399.90 per ton. January soybean oil fell 0.17¢ to close at 50.56¢ a lb.

- US equity markets closed lower mid-week, pausing a remarkable rally that pushed the Dow industrials index to several record highs in the past week. It was the biggest one-day percentage drop since September for the S&P 500 and the worst day since October for the DJIA and Nasdaq. The Dow Jones Industrial Average dropped 475.92 points, or 1.27%, to close at 37,082. The Standard & Poor’s 500 fell 70.02 points, or 1.47%, to close at 4,698.35. The Nasdaq Composite was down 225.28 points, or 1.5%, to close at 14.777.94.

- US crude oil prices advanced again Wednesday. The February West Texas Intermediate light, sweet crude future was up 28¢ to close at $74.22 per barrel.

- The US dollar index flipped to the high side Wednesday, rising for only the second time in seven sessions.

- US gold futures were lower Wednesday. The February contract was down $3.90 to close at $2,034.50 per oz.

Recap for December 19

- Soybean futures touched a one-week high early in Tuesday’s session, extending Monday’s gains, before dropping and closing lower on rainy Brazilian forecasts. Technical bounces were behind wheat futures’ gains Tuesday, offsetting pressure from continued inexpensive supply on the world market as exhibited in Egypt’s 480,000-tonne purchase of Russian wheat. Corn futures descended to a nearly three-week low. March corn futures fell 4¼¢ to close at $4.72¾ per bu. Chicago March wheat added 5¾¢ to close at $6.22¾ per bu. Kansas City March wheat added 13¾¢ to close at $6.41½ per bu. Minneapolis March wheat was up 6¾¢ to close at $7.28¼ per bu. January soybeans fell 14½¢ to close at $13.12½ per bu. January soybean meal was down $9.60 to close at $403.20 per ton. January soybean oil added 0.09¢ to close at 50.73¢ a lb.

- US economic optimism had traders buying shares of companies such as Caterpillar and Walgreens Boots Alliance on Tuesday, helping push the DJIA to a fifth record-high close in five sessions. The Dow Jones Industrial Average added 251.90 points, or 0.68%, to close at 37,557.92. The Standard & Poor’s 500 added 21.81 points, or 0.59%, to close at 4,768.37. The Nasdaq Composite was up 98.03 points, or 0.66%, to close at 15,003.22.

- US crude oil prices advanced Tuesday. The February West Texas Intermediate light, sweet crude future was up 97¢ to close at $73.44 per barrel.

- The US dollar index declined Tuesday for the fifth time in the past six sessions.

- US gold futures were higher Tuesday. The February contract was up $12.10 to close at $2,038.40 per oz.

Recap for December 18

- US soy complex futures were initially lower but rallied and posted a daily gain on good export demand, including a proposed export tax increase on soy products by Argentina. Technical selling weighed on corn and wheat futures, the latter also pressured by plentiful, inexpensive Russian wheat that was expected to supply a substantial portion of Saudi Arabia’s 1.35-million-tonne purchase over the weekend. March corn futures dipped 6¢ to close at $4.77 per bu, but later months were mixed. Chicago March wheat pared 12¼¢ to close at $6.17 per bu. Kansas City March wheat fell 15¢ to close at $6.27¾ per bu. Minneapolis March wheat was down 9¼¢ to close at $7.21½ per bu. January soybeans added 11¼¢ to close at $13.27 per bu. January soybean meal was up $7.20 to close at $412.80 per ton. January soybean oil added 0.65¢ to close at 50.64¢ a lb.

- US stock prices continued to rally Monday, the S&P 500 coming off of a seventh consecutive week of gains, on investor confidence the US central bank will machinate a “soft landing,” returning inflation to its 2% target while avoiding a recession. The Dow Jones Industrial Average edged up 0.86 point to close at 37,306.02. The Standard & Poor’s 500 added 21.37 points, or 0.45%, to close at 4,740.56. The Nasdaq Composite was up 90.89 points, or 0.61%, to close at 14,904.81.

- US crude oil prices advanced Monday. The January West Texas Intermediate light, sweet crude future was up $1.04 to close at $72.47 per barrel.

- The US dollar index declined Monday as it did most days the previous week.

- US gold futures were higher Monday. The February contract added $4.80 to close at $2,040.50 per oz.